About Us

Welcome to Legacy Tax Services

We are here to help you with all of your tax needs.

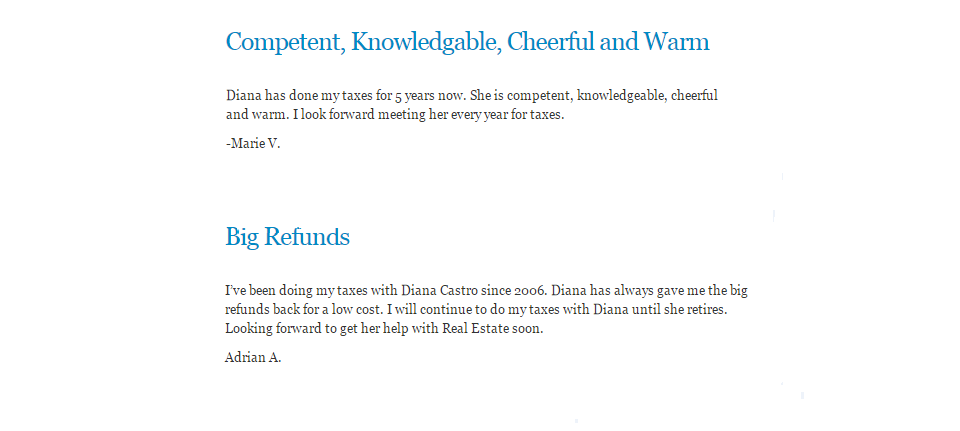

We have been helping businesses and individuals with tax preparation and tax planning strategies for over 10 years.

Our capable, experienced, trained, knowledgeable professional services of Legacy Tax Services help you to:

- Eliminate the worry, aggravation, headache and stress of doing your own taxes

- Free up your time to focus on things that matter in your life

- A trained tax specialist can find deductions that you may have overlooked

- An experienced tax pro will ensure accuracy and compliance with IRS code

- Professional tax preparation may minimize your risk of an IRS audit

- We help you find extra deductions

The IRS Federal Tax Code has become increasingly complex. Despite the proliferation of do-it-yourself tax software programs, more and more savvy tax filers are turning to trained, knowledgeable, experienced tax preparation pros to prepare and file their income taxes and to implement effective tax reduction and planning strategies.

Did you know?

When your tax return is signed by a tax professional, the Internal Revenue Service recognizes that a professionally prepared return has a higher accuracy rate and a higher standard of due diligence. For the self-employed, tax preparation fees are fully deductible on Schedule C. For self-employed people, this can translate into a whopping 40% savings in the tax prep fee actually paid. In many cases, ?found? deductions more than offset the cost of professional tax preparation.

- Simplify the tax planning and tax filing process

- Minimize your tax liability

- Maximize your tax return

- Ensure tax compliance and avoid fines and penalties

- Get your questions answered knowledgeably

- All tax years professionally prepared

- Returns electronically filed from Jan 15th ? October 15th

- Corrected and Amended returns filed

- Super fast refunds

- Maximum legal refund

- Most state tax returns

- Fast, efficient, confidential service

Call our office ((805) 650-1052) or send us a brief email with the form provided, and we will be in touch right away.